Welcome to another edition of the Neural Net!

In this edition: The best AI-Powered stock trading tools, data labeling pays more than Taylor’s Eras Tour, the cost of overly polite prompting, US tightens chip export controls, and how to use GenAI to make sense of your fridge. It might be Friday, but AI doesn’t take weekends off—and the headlines just keep coming.

▼

📈 Can AI Make You a Better Trader? Here's Where It Actually Helps

AI is changing how people invest—not by making crystal ball predictions, but by solving real problems: overwhelming data, emotional decision-making, and the sheer time it takes to trade well.

Here’s what AI brings to the table:

Speed – It digests and processes millions of data points in seconds—everything from earnings reports to technical signals.

Pattern Recognition – AI identifies trends in stock performance that humans might miss, especially across large datasets with complex relationships.

No Emotion – Unlike human traders, AI doesn’t panic sell or get FOMO. It operates on data, not feelings.

Most consumer-facing LLMs (aka ChatGPT, Gemini, etc) can’t access real-time market data, so they’re better for general research than active trading. But there are already several proven tools that are applying AI at scale:

Danelfin tackles decision paralysis by giving each stock a 1–10 score based on its short-term odds of beating the market. Instead of drowning in metrics, you get a simple signal based on thousands of inputs.

TrendSpider is for technical traders who want speed and automation. It scans charts, identifies trading patterns, and lets you test strategies or set up bots that trade when your conditions are met.

Ainvest simplifies research. Its AI chatbot explains stock fundamentals and technical signals in plain English, helping you understand why a trade might (or might not) make sense—before you hit “buy.”

🧠 But How Smart Is It, Really?

Not all AI investing tools are built the same. For every platform doing the real work, there’s another wrapped in buzzwords, powered by smoke and mirrors.

As we mentioned in our last edition, some so-called “AI” companies are being exposed—and it turns out the intelligence wasn’t just artificial, it was imaginary.

And let’s be honest: the stock market has always been a playground for hype and hustle. Add AI to the mix, and it’s even easier to sell a dream that doesn’t deliver.

Here’s how to tell the difference between a legitimate AI tool and an overhyped cash-grab:

Check the method: Does it explain how it scores or selects stocks? The more advanced the algorithms being used, the harder they are to explain—but when it’s your 💵 on the line, an explanation is owed. If someone’s selling an AI product, they should’ve put serious work into explaining how the algorithm gets its outputs—even if it’s not perfect.

Look for data transparency: Is it clear what data is being used (earnings, price trends, sentiment)? Is that data updated regularly?

Avoid black-box promises: “Guaranteed returns” is a 🚩. No tool can perfectly predict the market.

Look for real humans behind it: Legitimate products are built by teams with a track record in AI, finance, or both. If the creators are anonymous, unsearchable, or hiding behind cartoon avatars, proceed with caution.

Bottom line: AI can help you trade smarter—but only if you understand what it’s doing and stay in control. Use it as an edge, not a shortcut.

▼

Heard in the Server Room

OpenAI's Sam Altman revealed that ChatGPT users saying "please" and "thank you" are racking up "tens of millions" in electricity costs. A Future PLC survey found 70% of users are courteous to their AI assistants, with 12% apparently hedging their bets against a robot uprising (they must have read our AI 2027 edition). Despite the hefty price tag on these digital pleasantries, Altman believes encouraging good manners in the AI era is worth every kilowatt.

Berkeley and UCSF scientists have cracked the code on giving paralyzed patients their voices back with an AI brain-computer interface that turns neural activity into actual speech. The tech taps into the motor cortex and uses AI to translate brain signals into real-time conversation—all while preserving the patient's original voice through a clever text-to-speech model trained on pre-injury voice recordings. In what's nothing short of a communication breakthrough, people who've lost the ability to speak can now chat using what sounds like their pre-injury voice, even when they have zero remaining vocal function. We only wonder how long it will take to have mission impossible-style voice changers for perfect impersonations.

Nvidia's wallet just took a $5.5 billion hit after Uncle Sam restricted exports of its H20 AI chips, formerly the most advanced chip able to be sold in China, over concerns they could be used to create supercomputers. The timing couldn't be worse for the chip giant, as Chinese tech heavyweights Tencent, Alibaba, and ByteDance had been loading up on orders to fuel their AI ambitions hoping to follow in DeepSeek’s footsteps. Investors weren't thrilled with the news either, sending Nvidia shares tumbling 6% after hours—proving that even in the red-hot AI market, geopolitics can still throw cold water on tech's biggest players.

▼

The Swift Exit: How Lucy Guo Labeled Her Way Past Taylor

Lucy Guo, co-founder of Scale AI, will become the world’s youngest self-made female billionaire—edging out Taylor Swift—following a tender offer that values Scale AI at $25 billion. Guo’s early stake in the company is now reportedly worth $1.2 billion.

Guo co-founded Scale AI in 2016 with current CEO Alexandr Wang. The startup specializes in data labeling, using a “human-in-the-loop” approach. Its services have become essential for tech companies developing large-scale AI models, which depend on accurately labeled data for training (and a lot of it).

Her billionaire status will be cemented with only 2 years spent at the startup—she was reportedly fired in 2018 after disagreeing with Wang. She explained that the work was unfulfilling and that the day-to-day just felt like people in the Philippines labeling data on the cheap.

Guo might be breaking records, but her latest venture, Passes, is facing serious legal accusations. At the same time, Scale AI has been making headlines too—and not for the right reasons. When both co-founders are tied to companies caught up in controversy, it raises the question: is this just coincidence, or is there a common denominator?

⭐️⭐️⭐️ Give this newsletter 3 stars if you want a deep dive into Scale AI, its drama, and why billion-dollar valuations seem to come with billion-dollar red flags!

▼

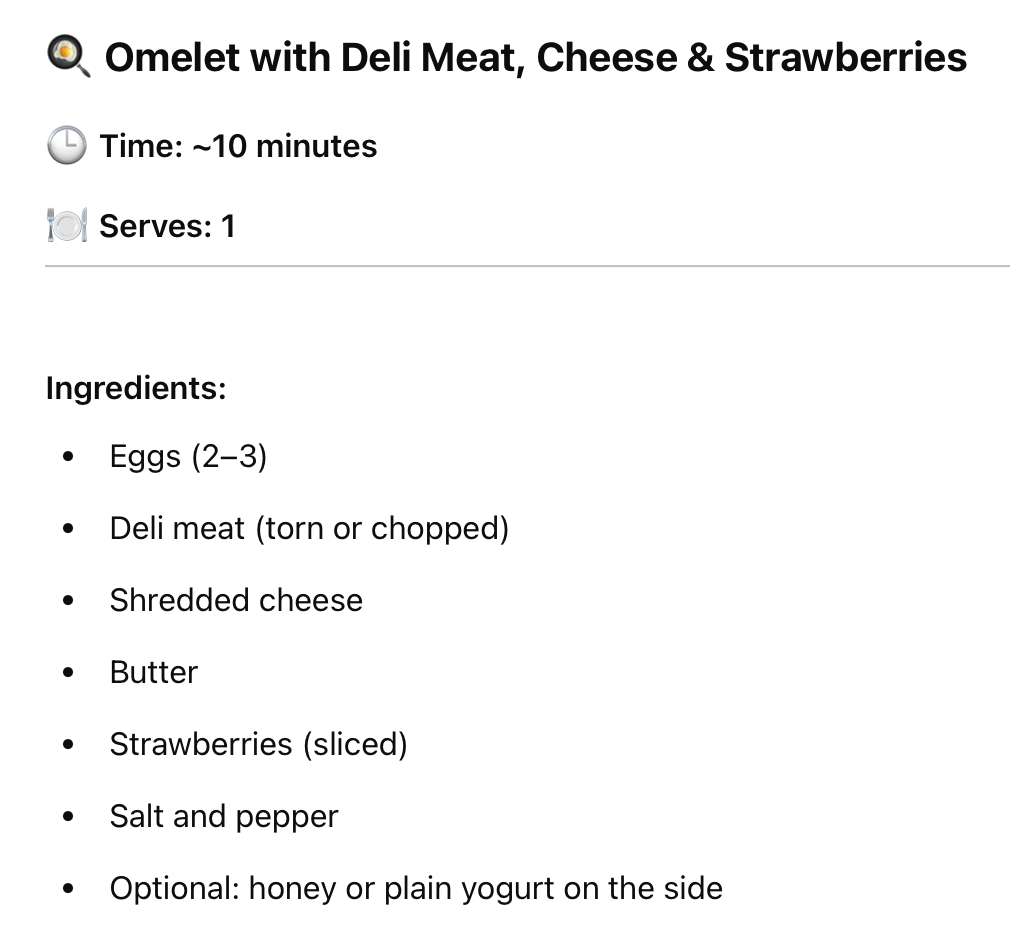

💡How To AI: What’s in My Fridge?

Have a full fridge but no idea what to make? Try this:

Prompt: "Give me a less than 30-minute meal idea with steps. Here’s a picture of my fridge."

It might sound simple, but it taps into some impressive capabilities—combining computer vision to recognize ingredients, and natural language processing to generate a custom recipe.

We tested it with this fridge photo: not a ton of obvious labels, drawers filled with partially obscured ingredients, and poor lighting.

ChatGPT identified what was (and wasn’t) there, and came back with a surprisingly reasonable meal idea. Not bad for a weekday dinner and with a fridge mostly full of breakfast food.

▼

That’s all for now! Rest up, recharge, and let your curiosity wander—we’ll be back soon with more.